28+ Total debt payoff calculator

The 2836 percent rule is a tried-and-true home affordability rule of thumb that establishes a baseline for what you. Lenders also require higher credit scores for shorter terms that increase your monthly debt service expenses.

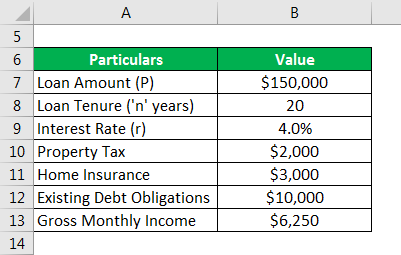

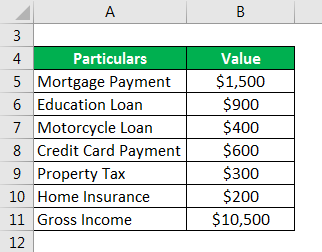

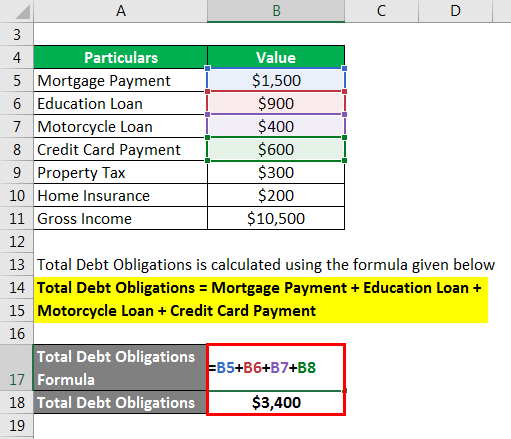

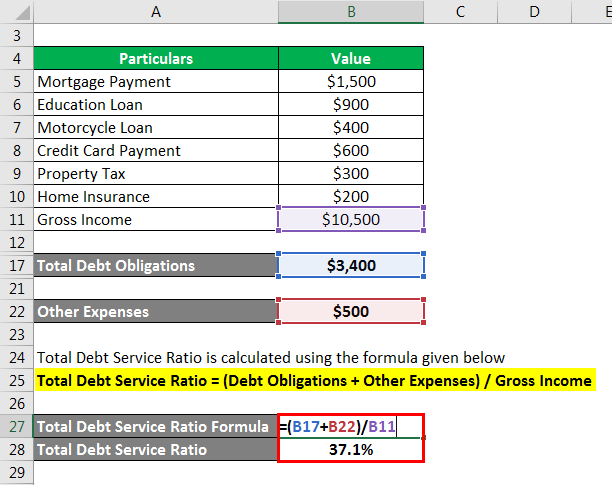

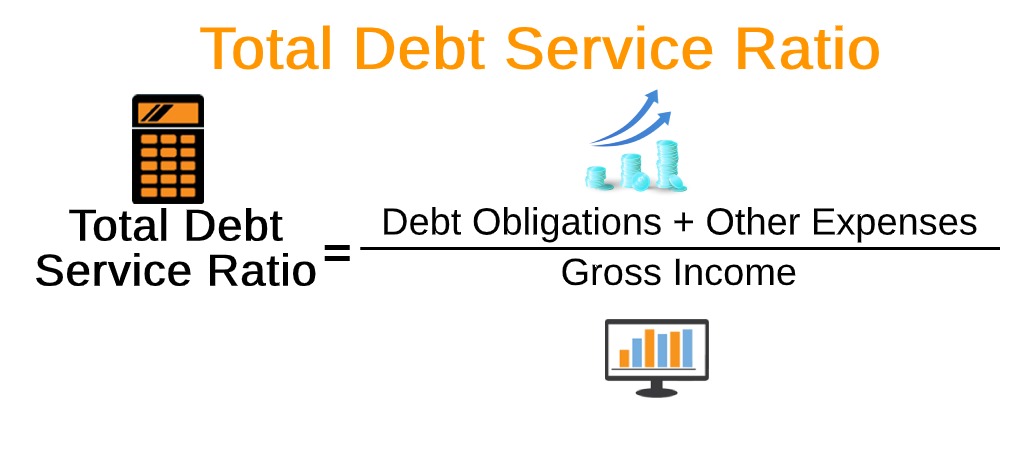

Total Debt Service Ratio Explanation And Examples With Excel Template

Since the outstanding balance on the total principal requires higher interest charges a more significant.

. In addition to making extra payments another great way to save money is to lock-in historically low interest rates. 6 to 30 characters long. And no more than 36 percent on total debt.

Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower. This is the first stage of the test and should be kept up for a total of 3 minutes. A back-end ratio includes your monthly housing costs plus any other monthly debt payments you have like credit cards student loans or medical bills.

Another way to plan how to pay off your debts is through the use of the debt snowball method. Early Payoff Amortization Schedule. Use this tool to calculate how many months you will require to pay-off your current credit card outstanding.

The debt will be paid off in 48 months while following the loan consolidation method it will be paid off in 28 months selecting this option will show the total value of the current payments if they were invested at this. 28 years 2 mons. If they had no debt their ratio is 0.

Use the debt payoff spreadsheet to make a plan then use the debt calculator Excel to determine with the time and amount you need to pay off all your debts. Making it ideal for paying off credit card debt consolidating other high-interest debt. But if you have a 30-year fixed mortgage you can still shorten your payment term by paying extra.

Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance. With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax income. Credit card payoff calculator.

Some calculators may use taxable income when calculating the average tax rate. For example the second stage would be at an incline of 12 the third at 14 and the tenth at 28. Debt consolidation is a smart option if you are carrying.

Use our free mortgage calculator to estimate your monthly mortgage payments. Wise money management means paying down debts with higher interest rates first. Payday and title loans usually come with high-interest rates and should be dealt with before focusing on a mortgage loan.

To calculate how much you can afford with this model determine your gross income before taxes and multiply it by 35. The 35 45 model. Cover the interest first with the remaining portion allocated to the principal.

Credit Card debts can be very costly. 6 min read Sep 16 2022. 1 year 10.

Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Simply enter the amount you wish to borrow the length of your intended loan vehicle.

Debt consolidation loan vs. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. Example 12 Months Example 36 Months Monthly Payment.

Lenders prefer your max front-end ratio to be 28 or lower but if youre following our plan your total housing costs shouldnt be more than 25 of your take-home pay. 015 - 200 APY. You can find various types of loan calculators online including ones for mortgages or other specific types of debt.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. 1 to 7 business days. ASCII characters only characters found on a standard US keyboard.

After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. Account for interest rates and break down payments in an easy to use amortization schedule. 49588 The more months to payoff would cost 32964 more than paying off the debt in fewer months.

Example of a Credit Card with Different Payoff Length. As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48. This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan.

Every following stage of the test should also be kept for 3 minutes. Flexible terms does not require collateral. A loan calculator is an automated tool that helps you understand what monthly loan payments and the total cost of a loan might look like.

Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and no more than 36 of your income on total debt payments including a mortgage student loans car loans and credit card debt. Balance transfer credit card With debt consolidation you ultimately need a plan in order to tackle your debt. Review your writers samples.

26 years 6 mons. Pooled investments made up of different types of bonds and other debt instruments. For this you need a credit card payoff spreadsheet along with a debt snowball calculator.

FREE formatting APA MLA Harvard ChicagoTurabian 24x7 support. 22 years 8 mons. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether.

Credit card payoff calculator. Must contain at least 4 different symbols. You may well be paying 18 interest in credit card debt and 5 in mortgage debt.

Based on total assets. This multiple debt payoff calculator tests 5 debt payoff methods to tell you including debt snowball debt avalanche. Getting The Most Out of Using This Calculator.

The loan calculator on this page is a simple interest loan calculator. For each subsequent test stage the inclineslope should be increased by 2.

Ex 99 1

Photography Order Form Template Free Elegant Shirt Order Form Staff Shirt Order Form Order Form Template Free Order Form Template Shirt Order

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

30 Simple Financial Projections Templates Free Legal Templates

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates

Ex 99 1

Tables To Calculate Loan Amortization Schedule Free Business Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

25 Free Payment Schedule Templates Excel Word Pdf Best Collections

Total Debt Service Ratio Explanation And Examples With Excel Template

I Received A 2200 Debt From Centrelink As A Result Of Their Ato Data Matching Program They Are Wrong And Are Choosing To Use Less Accurate Data To Generate A Debt

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates